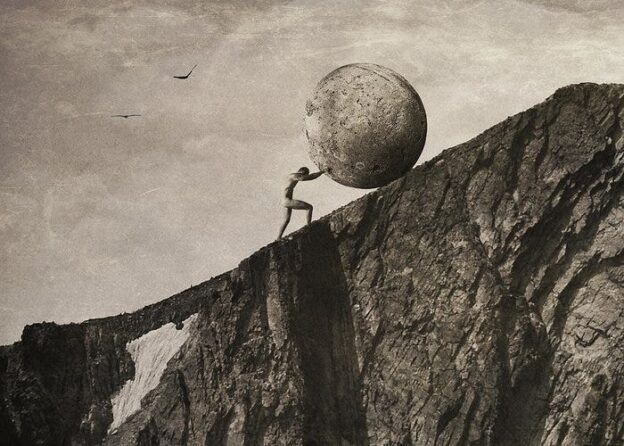

A forthcoming Local Government Strategy Forum event highlights the technology investment priorities of councils representing nearly £2 billion in budgets. The data shows strong interest in AI, automation and service transformation, but no explicit mention of cybersecurity or risk management. This article explores what that absence reveals about how local government frames technology strategy, and why resilience often remains invisible in leadership investment narratives.

Continue reading