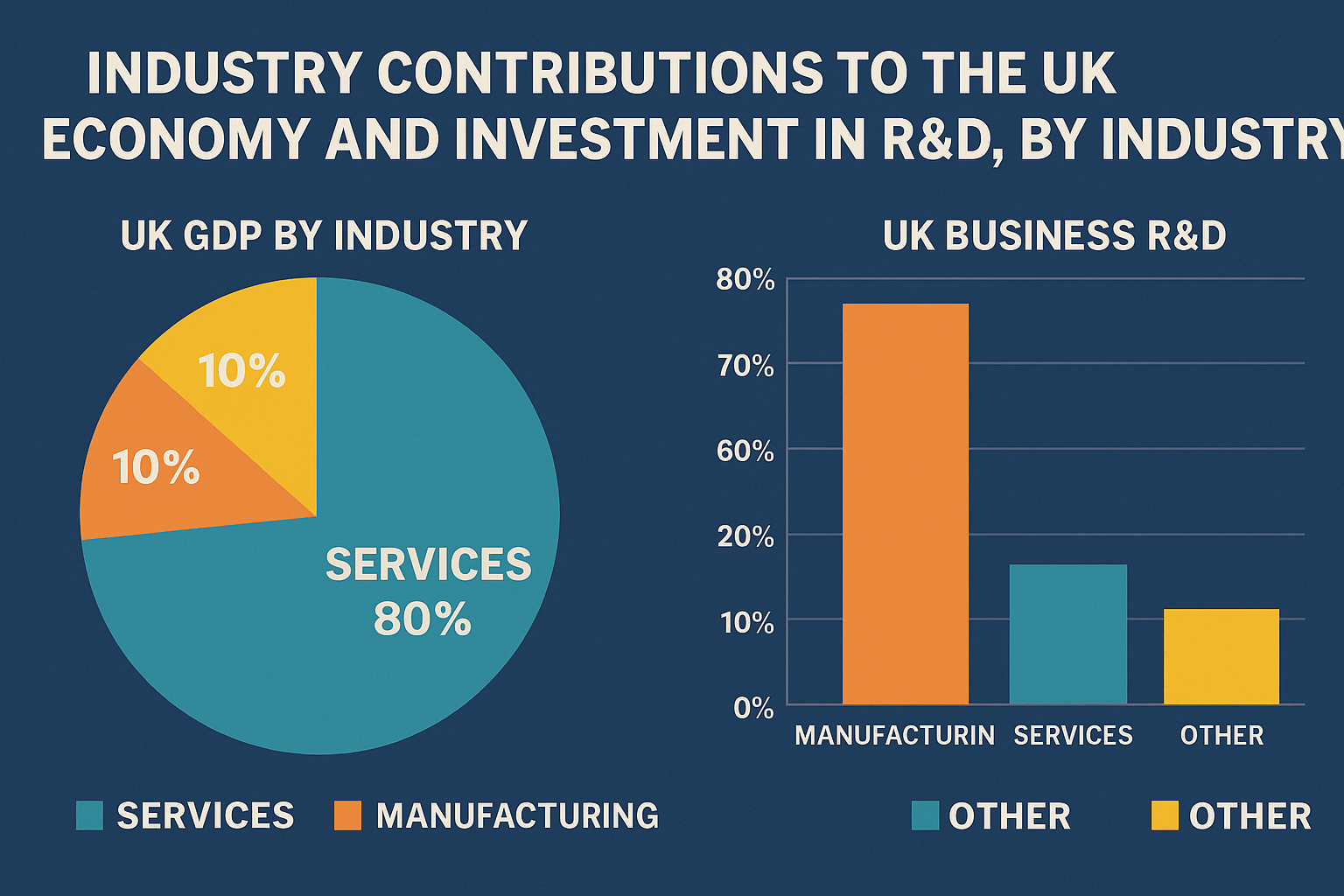

A critical look at the imbalance in the UK economy, highlighting the disproportionate contribution of the services sector to GDP and the overconcentration of R&D investment in manufacturing. It warns that this structural imbalance makes the UK vulnerable to economic shocks and calls for a more diverse and innovation-driven industrial strategy.

Continue reading

Industry contributions to the UK economy and investment in R&D; by industry

Leave a Reply