Understanding your stakeholder landscape is key to scaling effectively, especially in cybersecurity, where trust, standards, and adoption often hinge on who’s in the room. This article explores how Cyber Tzar, a cybersecurity scale-up specialising in supply chain risk and cyber risk scoring, applies the Stakeholder Mapping Grid to guide its strategic engagement.

From regulators and enterprise customers to SME advocates and peripheral players, the grid helps prioritise resources and shape messaging for maximum impact. This structured approach ensures that Cyber Tzar aligns time and investment with the people and institutions that matter most.

This article is with thanks to Robin Kennedy and Emma Fadlon of Innovate UK, based on my time with the academic leaders on the 2025 CyberASAP cohort. Thank you!

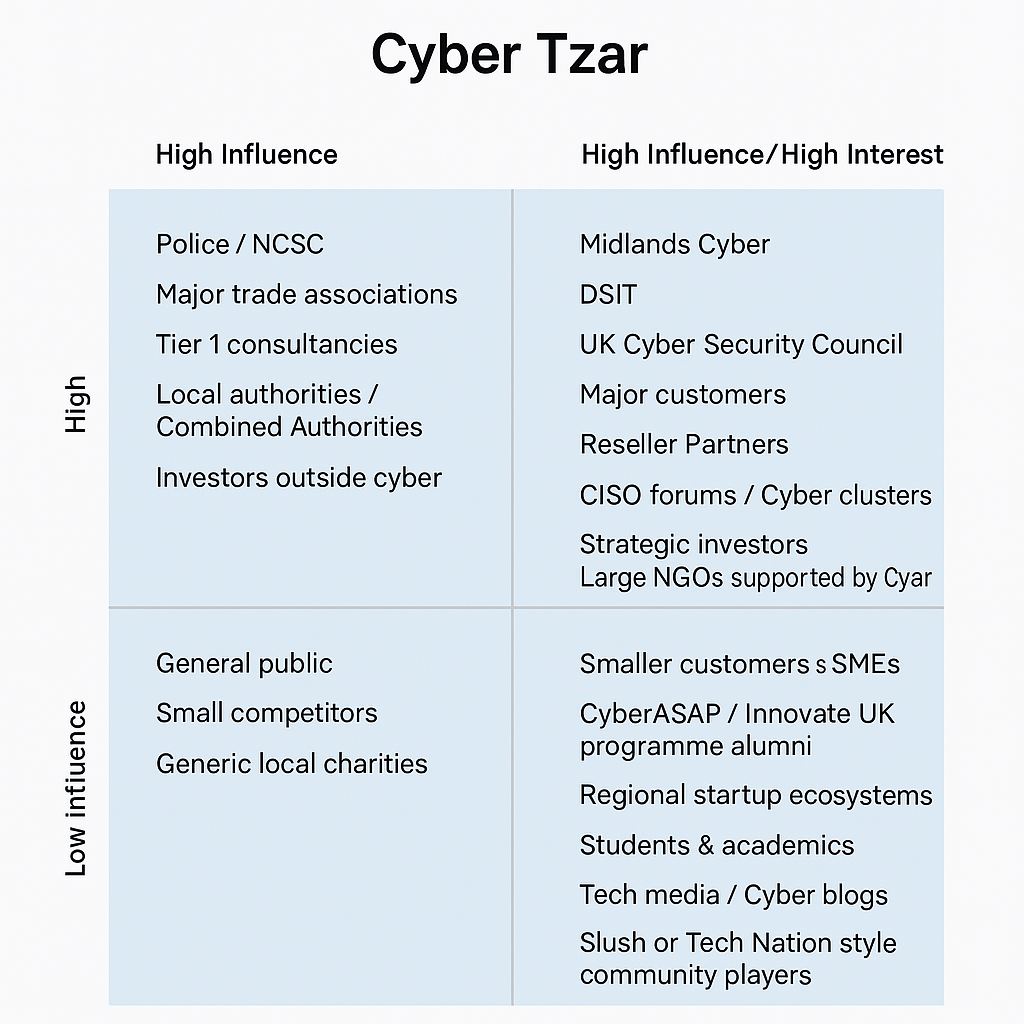

1. Manage Closely (High Influence / High Interest)

Strategic relationships, key decision-makers

- Midlands Cyber – strategic regional partner

- DSIT (Department for Science, Innovation & Technology) – funding, policy, influence

- UK Cyber Security Council – shaping standards and professionalisation

- Major customers – e.g., large insurers, Tier 1 automotive firms

- Reseller partners – delivering high-value client relationships

- CISO forums / cyber clusters – e.g., UKC3, CWG

- Strategic investors – with cyber/insurtech expertise and capital

- Large NGOs – currently supported by Cyber Tzar and highly engaged

2. Keep Satisfied (High Influence / Low Interest)

Powerful stakeholders not yet fully engaged

- Police / NCSC (central government units) – high potential allies, limited day-to-day involvement

- Major trade associations – e.g., TechUK, ABI (Association of British Insurers)

- Tier 1 consultancies – e.g., PwC, Deloitte – may later integrate risk scoring tools

- Local / combined authorities – control regional procurement but interest is varied

- Non-cyber investors – may be curious, but not yet committed

3. Keep Informed (Low Influence / High Interest)

Supporters, early adopters, and advocates

- Smaller customers and SMEs – highly affected by supply chain vulnerabilities

- CyberASAP / Innovate UK alumni – informed peer network

- Startup ecosystems – e.g., Barclays Eagle Labs, SuperTech, Birmingham Tech

- Students and academics – active interest in cyber risk research and metrics

- Tech media / cyber blogs – e.g., Infosecurity Magazine, seeking new stories

- Community players – e.g., Slush or Tech Nation contacts, low power but high enthusiasm

4. Monitor (Low Influence / Low Interest)

Minimal effort until activated

- General public – unless affected by a data breach or policy event

- Small competitors – low market influence at present

- Generic local charities – unless directly involved in cyber initiatives

- Peripheral startup networks – not focused on cyber/tech

- Journalists in unrelated sectors – e.g., lifestyle or culture press

Summary

Using this stakeholder map, Cyber Tzar can focus its outreach where it counts, balancing high-touch engagement with strategic patience. It also surfaces where dormant relationships could grow into strategic partnerships or support networks over time.